U.S. tariffs – The storm isn’t over: Which Vietnamese industries will be hit the hardest?

Although former President Donald Trump’s proposed 46% tariff on Vietnamese goods has been temporarily postponed, the risk hasn’t gone away. Over the next 90 days, this policy could be reactivated—and if it is, several of Vietnam’s key export industries may face severe consequences.

Over the next 90 days, this policy could be reactivated—and if it is, several of Vietnam’s key export industries may face severe consequences.

So, if the worst-case scenario becomes a reality, which sectors will suffer the most? Let’s explore this with Hoang Vuong Paper Packaging:

1. Textiles & Garments – The Flagship Export Under Threat

Textile and garment exports to the U.S. account for tens of billions of dollars annually. Should a 46% tariff take effect, Vietnamese apparel would lose its price competitiveness against rivals such as Bangladesh, India, or Mexico—countries that enjoy favorable trade terms with the U.S. This could lead to mass order cancellations and job losses for hundreds of thousands of workers in the industry.

Textile and garment exports to the U.S. account for tens of billions of dollars annually.

2. Wood & Furniture – Losing the Pricing Edge

The U.S. is Vietnam’s largest market for wood and furniture products. With a steep tariff in place, product prices would rise significantly, prompting American importers to shift toward alternative sources like Malaysia, Brazil, or Turkey. The wood industry, which is just recovering from the pandemic, may once again face stagnation.

The U.S. is Vietnam’s largest market for wood and furniture products.

3. Seafood – A Double Shock of Cost and Market Loss

Shrimp and pangasius have already struggled with rising farming, quality control, and logistics costs. A 46% tariff would render Vietnamese seafood too expensive for the U.S. market, effectively shutting it out. This would disrupt the entire supply chain—from farmers and fishermen to processing companies.

This would disrupt the entire supply chain—from farmers and fishermen to processing companies.

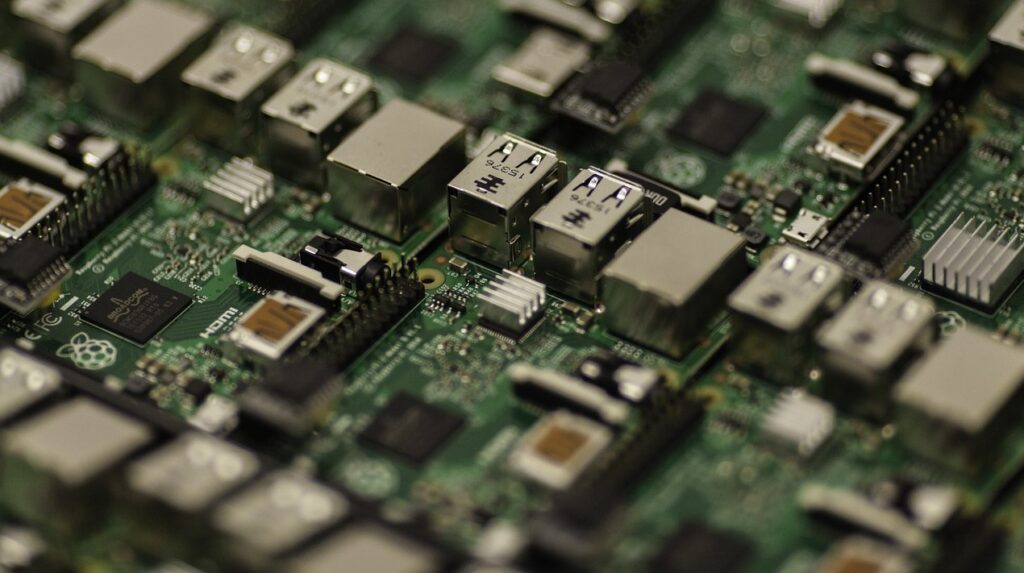

4.Electronics – Risk of Supply Chain Disruption

Vietnam has become a critical hub for electronics assembly in the global supply chain. But as input costs rise and output is heavily taxed, tech giants may shift their operations to other countries. This poses a serious threat to foreign direct investment and high-skilled employment in Vietnam.

Vietnam has become a critical hub for electronics assembly in the global supply chain.

5. Paper Packaging – Rising Costs, Shrinking Margins

As a key supporting industry for exports, the paper packaging sector will not be spared. Higher costs of imported materials, combined with a shrinking U.S. market, may severely affect profitability and expansion efforts for Vietnamese packaging companies.

Higher costs of imported materials, combined with a shrinking U.S. market, may severely affect profitability and expansion efforts for Vietnamese packaging companies.

6. A Message from Hoang Vuong Paper Packaging

At Hoang Vuong Paper Packaging, we are committed to standing by our clients and partners

In today’s volatile global landscape, Vietnamese businesses must not only craft long-term growth strategies but also be agile in managing external risks. At Hoang Vuong Paper Packaging, we are committed to standing by our clients and partners—providing eco-friendly, cost-efficient, and high-quality packaging solutions to help navigate challenges and seize emerging opportunities.